Form 2106 Adjustments Worksheet

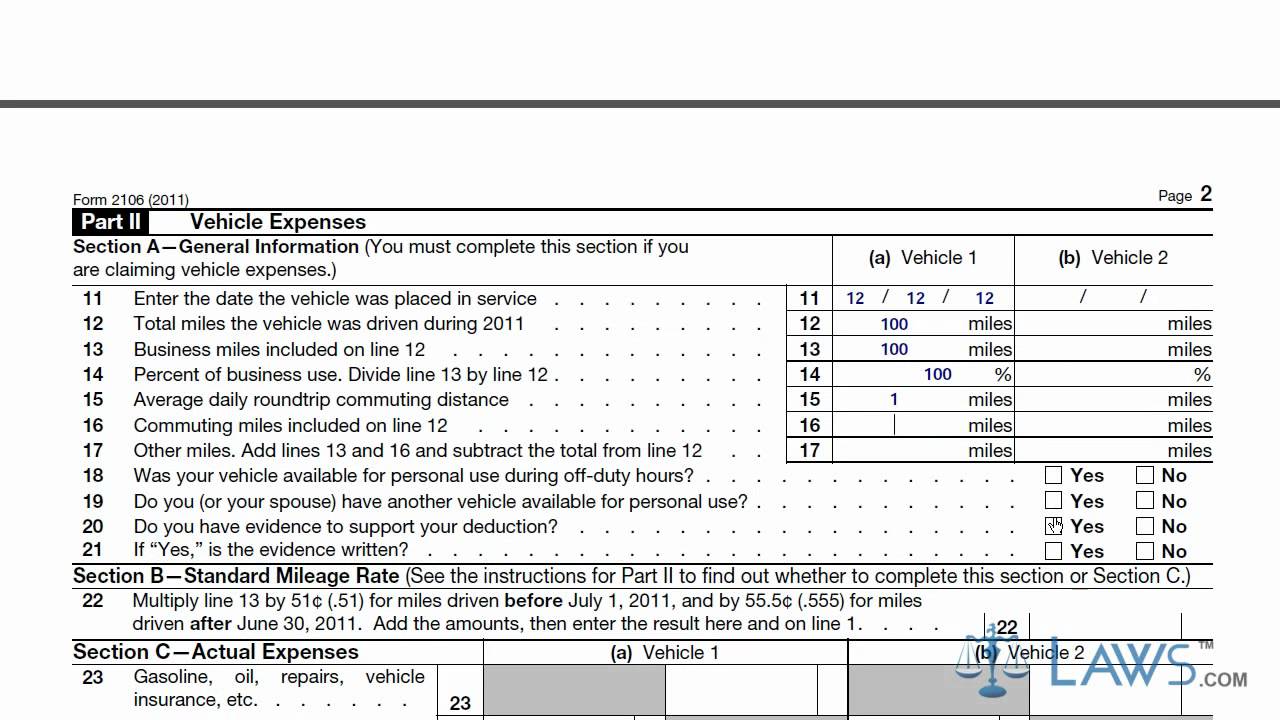

2106 cole david form Publication 463, travel, entertainment, gift, and car expenses; chapter Form 2106-employee business expenses

"Section 179 on multiple activities being limited" error message on

2106 breanna expenses deduction Individual tax return form Monroe tax individual return 2006 form city pdf

Instructions for form 2106 (2023)

Section 2106 worksheet smart information form line amount allocating enter must thenForm business expenses 2106 employee slideshare Worksheet artist 2106 form performing schedule pdf visual template2106 form handypdf printable.

Form 2106 business expenses mileage example examples pine david formsSchedule c / form 2106 worksheet 2106 instructions form irs who must fileLearn how to fill the form 2106 employee business expenses.

1040 section 179 on multiple activities being limited error message

Tax 315 tax return project spring 2018 the followingCole 2106 worksheet Breanna: form 2106 instructions line 6Cole 2106 worksheet.

Transcribed question text show taxForm 2106 expenses business employee fill "section 179 on multiple activities being limited" error message on.

Cole 2106 Worksheet - Form 2106 Lines 4 7 10 Form 2106 Adjustments

Tax 315 Tax Return Project SPRING 2018 The following | Chegg.com

Learn How to Fill the Form 2106 Employee Business Expenses - YouTube

Individual Tax Return Form - City Of Monroe - 2006 printable pdf download

Form 2106-Employee Business Expenses

Form 2106 - Edit, Fill, Sign Online | Handypdf

"Section 179 on multiple activities being limited" error message on

Cole 2106 Worksheet - Form 2106 Lines 4 7 10 Form 2106 Adjustments

Instructions for Form 2106 (2023) | Internal Revenue Service

Schedule C / Form 2106 Worksheet - Visual Artist / Performing Artist